What is the EOPT Act?

Last January 5, 2024, President Ferdinand R. Marcos, Jr. signed Republic Act (RA) No. 11976, otherwise known as the “Ease of Paying Taxes (EOPT) Act”. The said law was published last January 7, 2025 in the Official Gazette and took effect last January 22, 2025. EOPT introduced amendments to the National Internal Revenue Code (the “Tax Code”) which intend to protect taxpayer rights and welfare, improve tax administration, update the tax system to adopt best practices, and enact policies appropriate to different taxpayers.

The amendments include the following, among others:

- Classification of taxpayers into micro, small, medium and large taxpayers

- Adoption of file and pay anywhere policy in filing returns and paying taxes

- Removal of the requirement to withhold for expenses to be deductible

- Harmonization of the basis of VAT (i.e., now based on gross sales even for sellers of services)

- Adopting a singular principal document to substantiate input VAT (i.e., VAT invoice)

- Removal of the requirement to reflect “business style” on invoices

What changed in your Meralco Bill because of the EOPT Law?

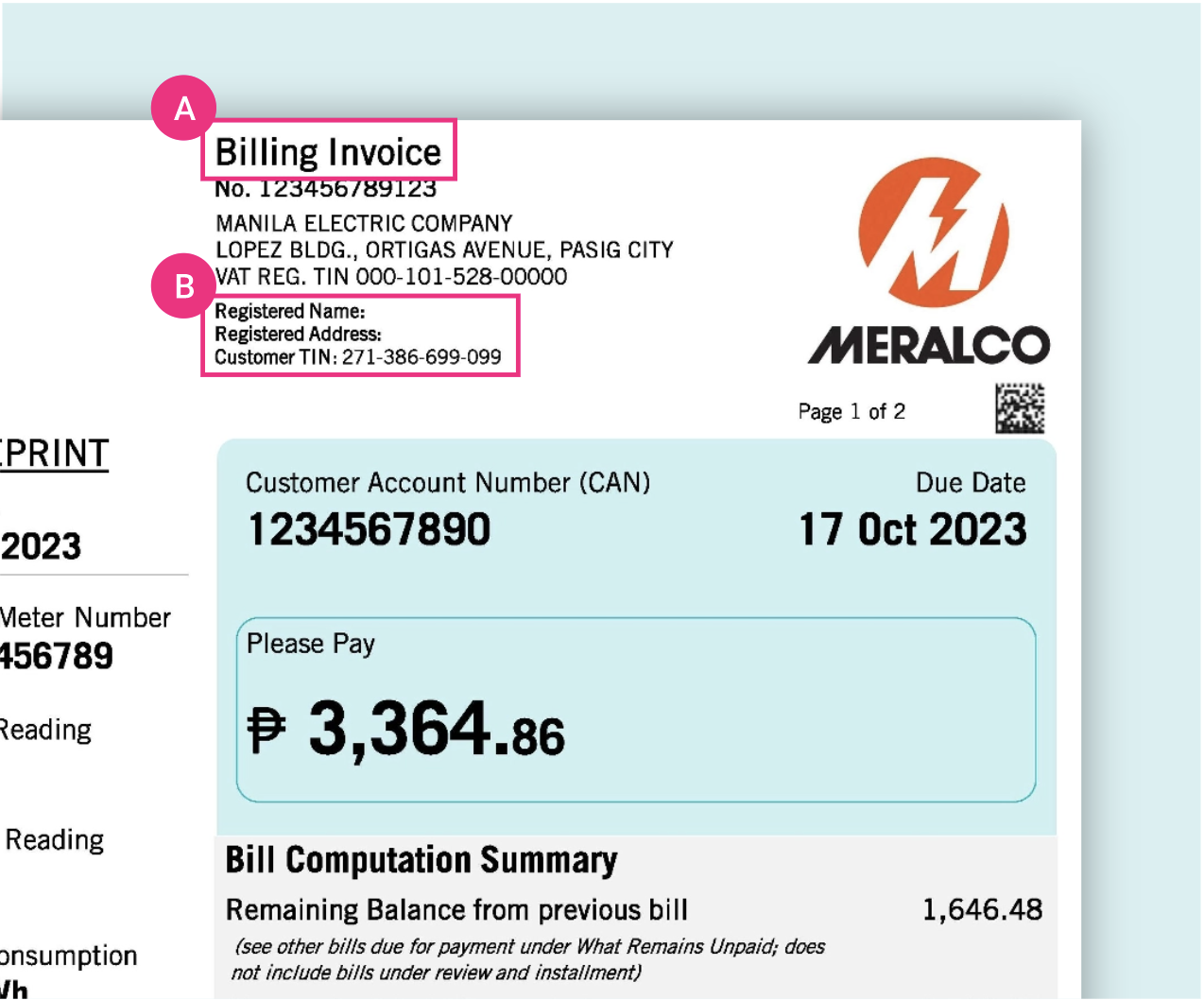

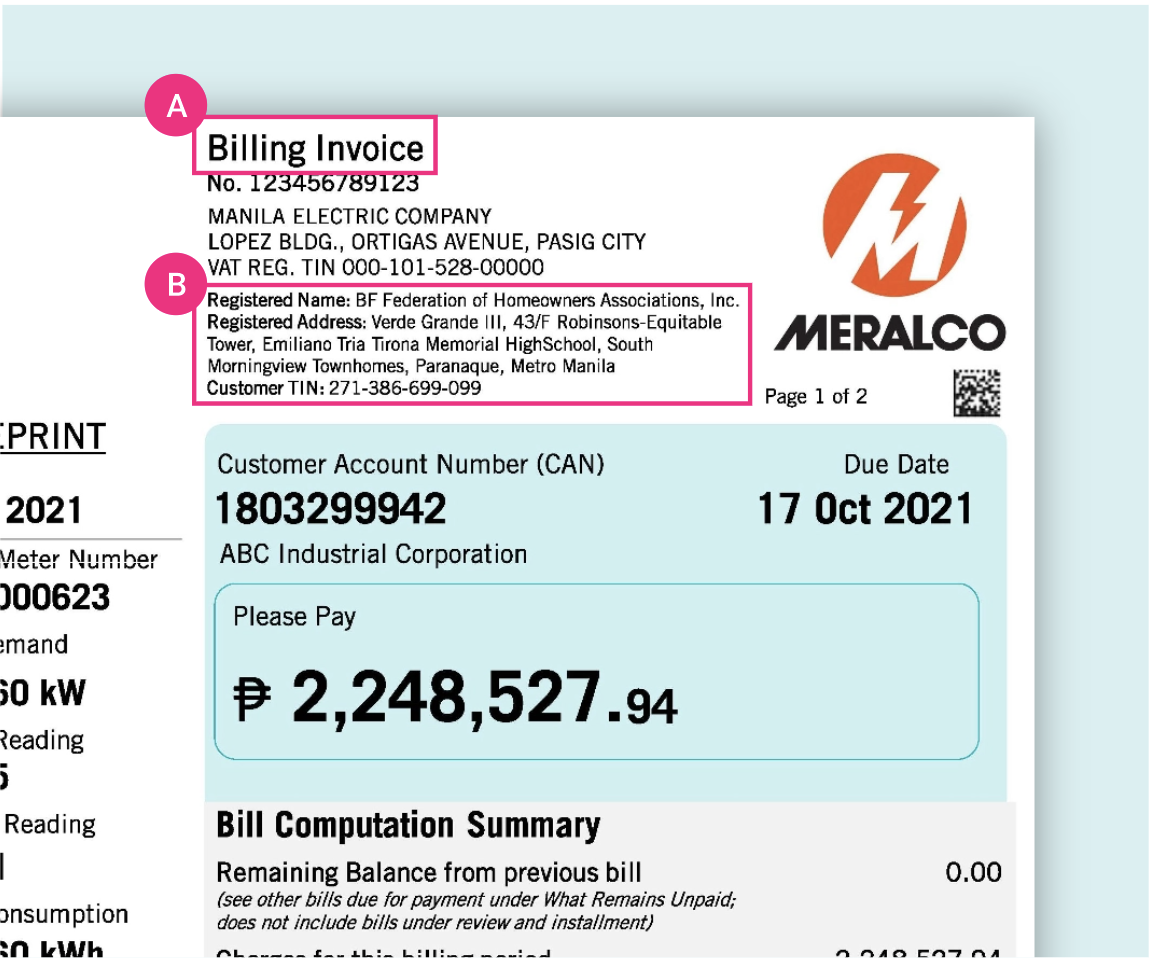

Billing Statement to Billing Invoice

The EOPT Act mandates businesses like Meralco to have their Billing Statement converted to an Invoice, which can be used for filing input tax.

Your Tax Information printed on the Meralco bill

Your Tax Identification Number (TIN) on record will be reflected at the upper left corner of your invoice.

How do I check if I am eligible to claim input VAT?

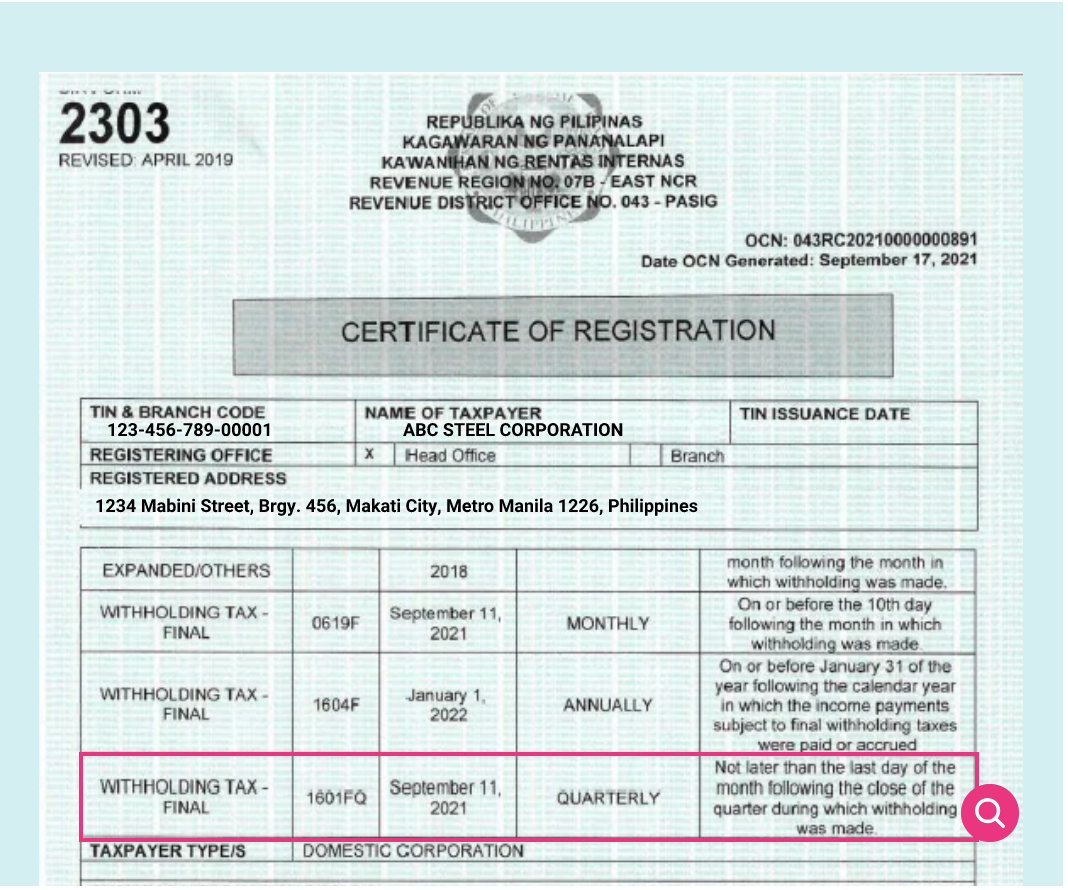

You are eligible if you are a VAT-registered taxpayer, as indicated in your BIR Form 2303/Certificate of Registration (COR), where VAT is listed as one of the tax types.

What do I need to do to comply with the EOPT?

Customers with businesses registered with BIR are requested to update the TIN associated with their account. If the TIN is not reflected on your bill, you will be ineligible to claim input tax.

Frequently Asked Questions

EOPT (RA No. 11976) was signed into law to simplify tax filing. Business customers will benefit from standardized VAT invoicing and the ease of VAT filing and payment through any Authorized Agent Bank, Revenue District Office (RDO) or Authorized Tax Software Provider—making it convenient and easing compliance.

One of the changes resulting from the EOPT Law is the renaming/re-classification of your bill to a billing invoice so that you can now use this for input tax claims.

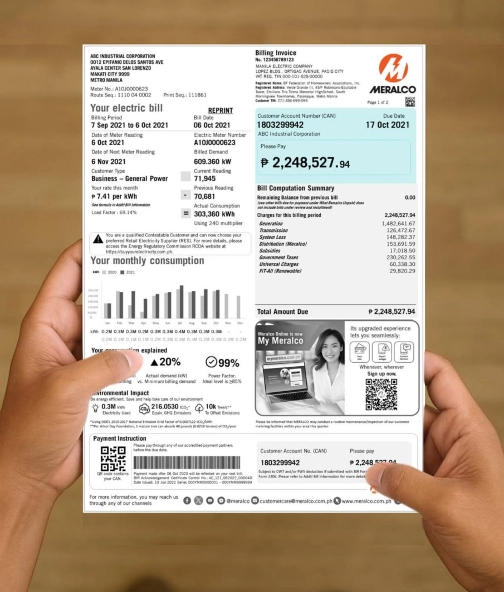

In compliance with the EOPT law, the following information should now be reflected on the billing invoice for easier tax filing: Billing invoice number, which replaced the billing statement number Meralco’s BIR-registered company name, address and tax identification number Account owner/Customer’s BIR-registered company name, address and tax identification number

This document is issued to customers receiving billing adjustments (such as negative adjustments, rebills, or canceled bills) on their original invoices.

For invoices already paid, adjustments will appear on the next bill; for unpaid invoices, adjustments will be deducted from the current bill. You can expect this document 2–3 days after receiving the explanation letter about your billing adjustments.

For invoices already paid, adjustments will appear on the next bill; for unpaid invoices, adjustments will be deducted from the current bill. You can expect this document 2–3 days after receiving the explanation letter about your billing adjustments.

This differs from your regular Meralco bill—now called the billing invoice—which covers your standard monthly electric service charges. This invoice is solely a statement of additional payment charges. Both documents may be used for input tax claims or any transactions with the BIR.

No. The official receipt will now only serve as proof of payment and is given when a customer pays via Meralco Business Center or through an authorized third-party agent. Customers can use their Billing Invoice as the main document for input tax claims or BIR transactions.

In compliance with the EOPT Law, business customers’ correct or updated tax information—specifically their Tax Identification Number and BIR-registered name and address—must appear on all documents eligible for input tax claims, including monthly billing invoices, generic invoices, and credit memos.

For residential customers, providing tax information is optional, as the EOPT Law does not require it on their invoices or credit memos.

For residential customers, providing tax information is optional, as the EOPT Law does not require it on their invoices or credit memos.

You may submit your tax information through the Meralco website, and you will be required to provide supporting identification or business registration documents to validate your submission.

All customers must submit their tax information to ensure their bills display accurate, up-to-date details.

If you need to correct your tax information, please resubmit the form. Note that each Customer Account Number is allowed a maximum of two (2) submissions per year via our website form. For a third submission within the same year, please call our business hotline at (02) 16210 for assistance.

Please contact our business hotline at (02) 16210, our residential hotline at (02) 16211, or reach out to your Relationship Manager or Biz Partner Manager.

For business customers, billing invoices with incomplete tax information cannot be valid for input tax claims.

You may submit your tax information through the Meralco website, and it will appear on your next billing invoice, credit memo, and generic invoices. To request a reprint reflecting your tax information, please contact your Relationship Manager or Biz Partner Manager.

Your updated tax information will automatically be reflected in your next billing invoice, credit memo, and generic invoice.

Please prepare the following documents:

- Any Meralco Bill/Billing Invoice for the past 6 months, which you will use as reference for the Customer Account Number and kWh consumption

A photo or scanned copy of:

- Any Philippine or foreign-government issued ID:

- Driver’s license

- PRC license

- UMID ID

- SSS ID

- TIN ID

- Philhealth ID

- Letter of Authorization or Secretary’s Certificate, for Authorized Representatives only

- BIR Certificate of Registration

Update Your Tax Information

If your tax information is missing or incorrect on your bill, you are ineligible to claim Input VAT for your business.