What is the EOPT Act?

Republic Act (RA) No. 11976, otherwise known as the “Ease of Paying Taxes (EOPT) Act” introduced amendments to the National Internal Revenue Code (the “Tax Code”). These intend to protect taxpayer rights and welfare, improve tax administration, update the tax system to adopt best practices, and enact policies appropriate to different taxpayers.

The amendments include the following, among others:

- Classification of taxpayers into micro, small, medium and large taxpayers

- Adoption of file and pay anywhere policy in filing returns and paying taxes

- Removal of the requirement to withhold for expenses to be deductible

- Harmonization of the basis of VAT (i.e., now based on gross sales even for sellers of services)

- Adopting a singular principal document to substantiate input VAT (i.e., VAT invoice)

- Removal of the requirement to reflect “business style” on invoices

How will this affect your billing and payment experience?

Changes in the Meralco Bill

The EOPT Act mandates businesses, like Meralco, to include certain information and roll out changes on your Meralco bill that can be used for filing input tax.

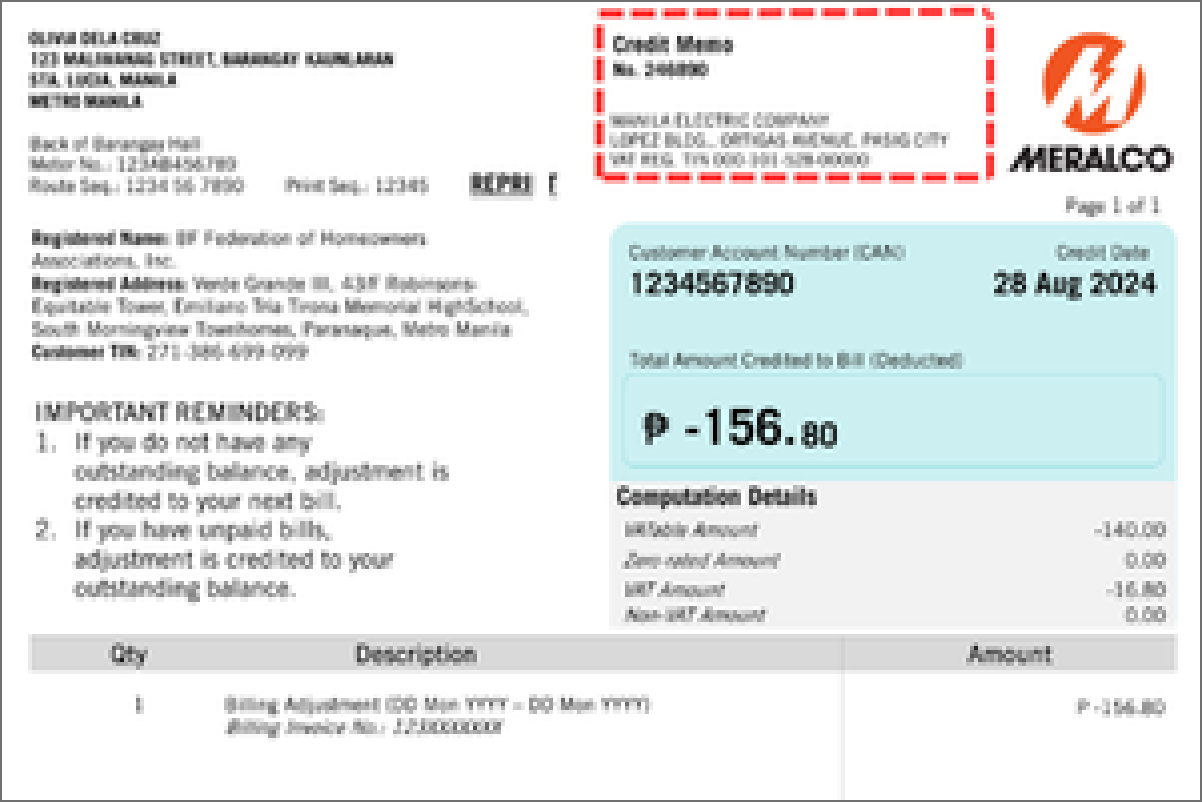

Issuance of Credit Memo

This document is issued for billing adjustments like rebills or cancellations. For paid invoices, adjustments appear on your next bill; for unpaid ones, they're deducted from the current bill. Expect this document 2–3 days after the adjustment letter.

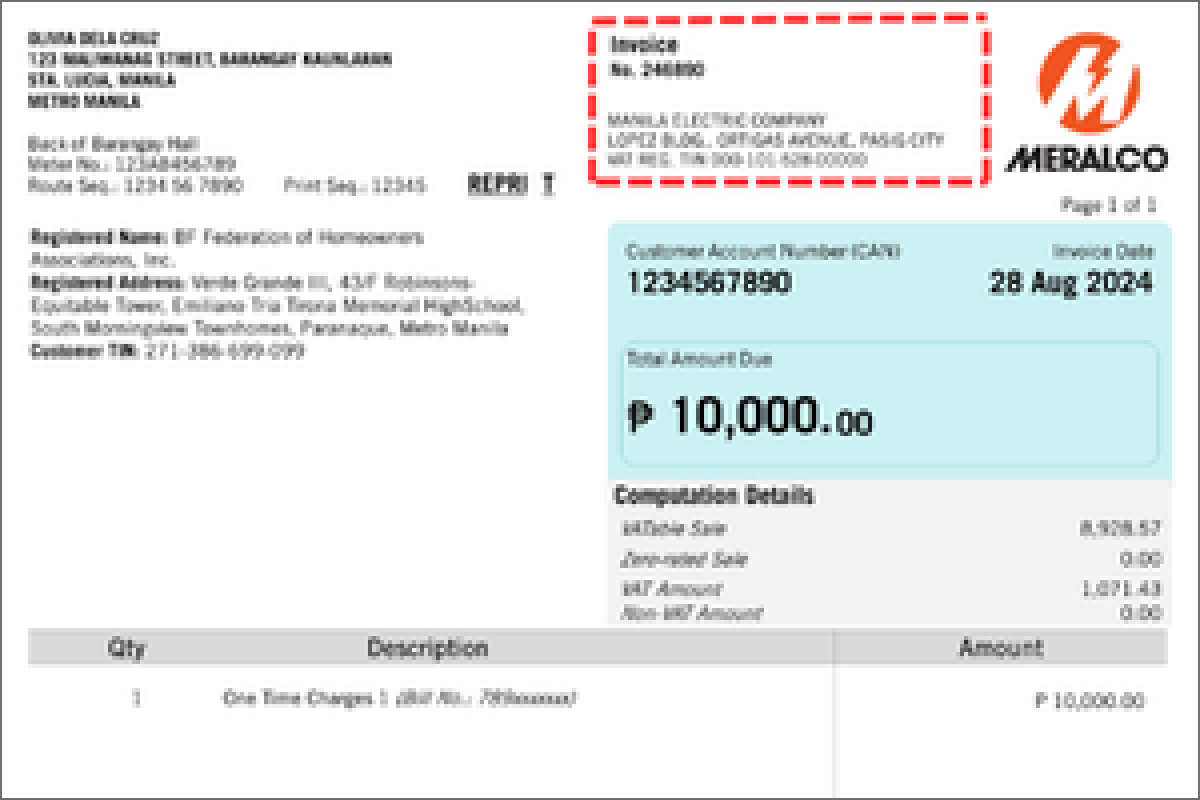

Issuance of Generic Invoice

This document is issued to customers to show extra charges that are not included in the regular monthly electric bill that have already been paid. These may include fees such as reconnection, DIS, DAS, or adjustments from past bills.

Issuance of Official Receipt

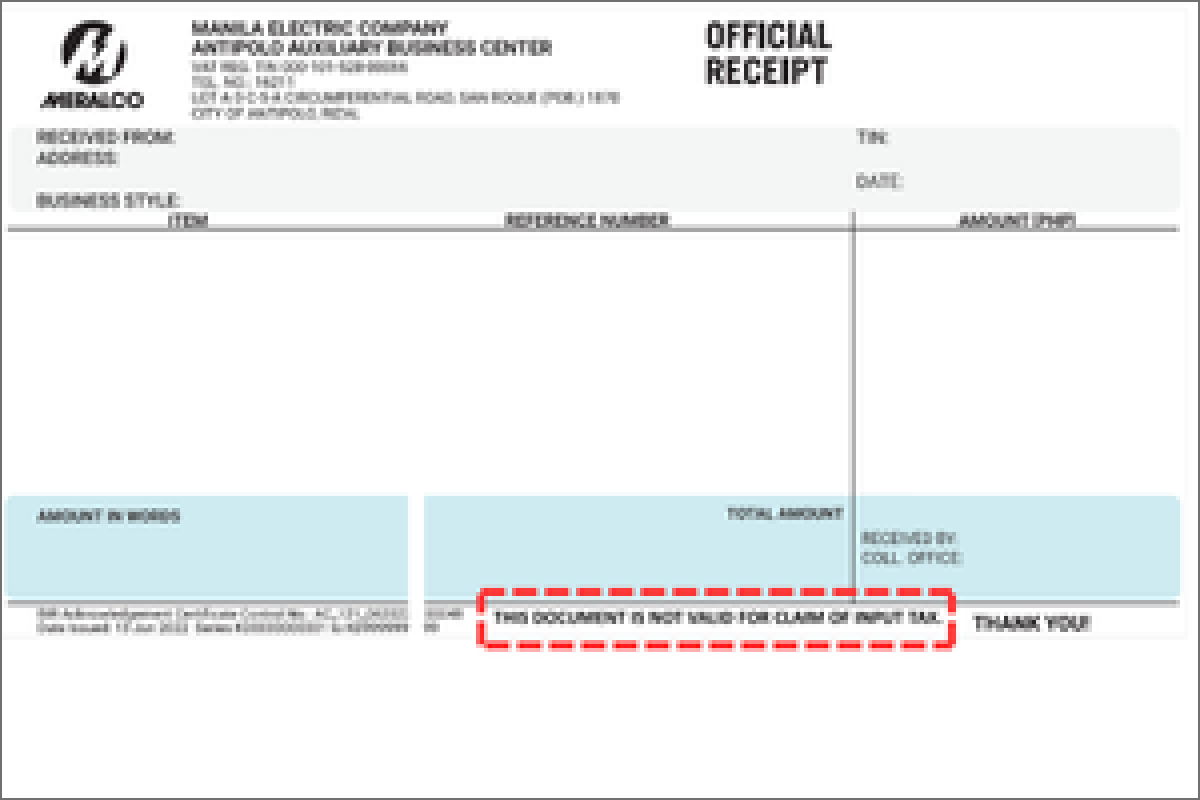

Since the billing invoice will now be used for input tax claims, a note will be printed at the bottom of the OR which says: THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX

Frequently Asked Questions

EOPT (RA No. 11976) was signed into law to simplify tax filing. Business customers will benefit from standardized VAT invoicing and the ease of VAT filing and payment through any Authorized Agent Bank, Revenue District Office (RDO) or Authorized Tax Software Provider—making it convenient and easing compliance.

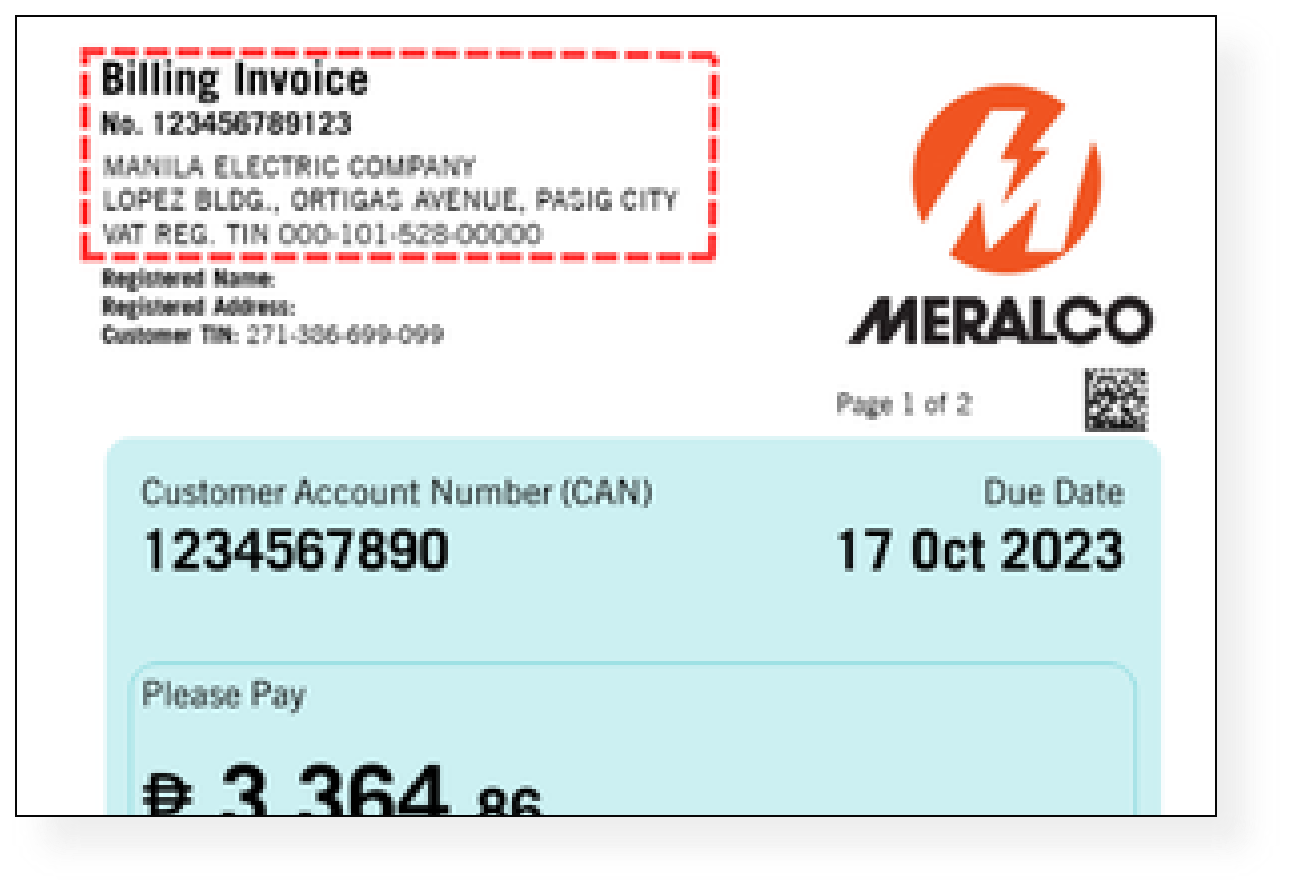

One of the changes resulting from the EOPT Act is the renaming/re-classification of your bill to a billing invoice so that you can now use this for input tax claims.

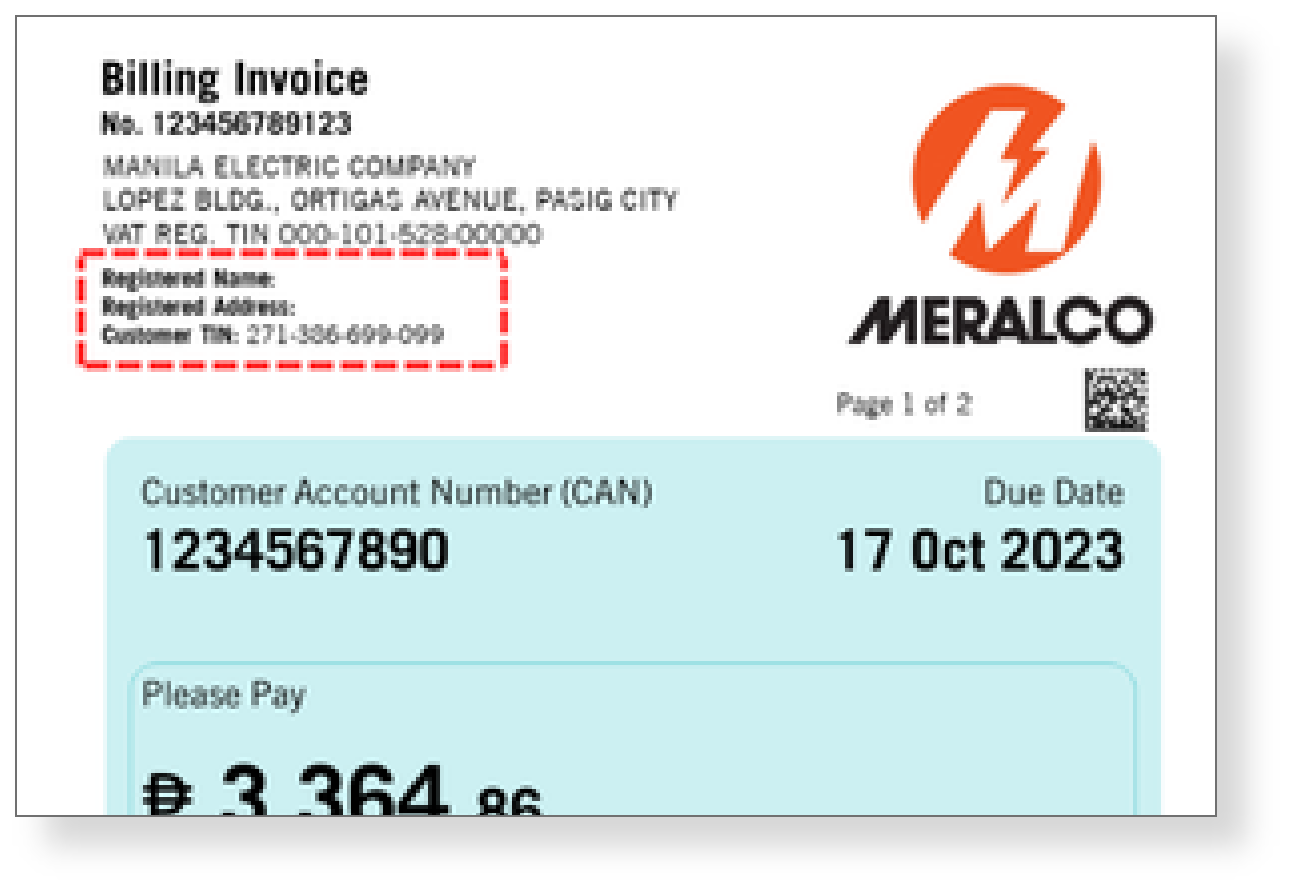

In compliance with the EOPT Act, the following information should now be reflected on the billing invoice for easier tax filing:

- Billing Invoice number, which replaced the Billing Statement number

- Meralco’s BIR-registered company name, address and Tax Identification Number

- Account owner/Customer’s BIR-registered company name, address and Tax Identification Number

This document is issued to customers receiving billing adjustments (such as negative adjustments, rebills, or canceled bills) on their original invoices.

For invoices already paid, adjustments will appear on the next bill; for unpaid invoices, adjustments will be deducted from the current bill. You can expect this document 2–3 days after receiving the explanation letter about your billing adjustments.

For invoices already paid, adjustments will appear on the next bill; for unpaid invoices, adjustments will be deducted from the current bill. You can expect this document 2–3 days after receiving the explanation letter about your billing adjustments.

This differs from your regular Meralco bill—now called the Billing Invoice—which covers your standard monthly electric service charges. This new generic invoice is a summary of additional payment charges to cover the remaining balance of the bill after adjustments to be settled (Positive Billing Adjustments, Service Irregularity Bills, etc.). Both documents may be used for input tax claims or any transactions with the BIR.

No. The official receipt will now only serve as proof of payment and is given when a customer pays via a Meralco Business Center or through an authorized third-party agent. Customers should use their Billing Invoice as the main document for input tax claims or BIR transactions.

For residential customers, providing tax information is optional, as the EOPT Act does not require it on their invoices or credit memos.

For residential customers, providing tax information is optional, as the EOPT Act does not require it on their invoices or credit memos.